What Category Does Your Credit Score Fall Into?

Your credit score is a number lenders use to determine whether you’re worthy of credit or not. Credit scores are usually divided into five categories: Excellent: If your credit score ranges anywhere between 740 to 850, it is considered excellent. Having a score this high normally means you’ll be approved…

Read More

Why You Shouldn’t Ignore a Credit Score Because It Has a Fee

Just because a credit card has a fee doesn't mean it's something you should overlook and rule out. Here are some reasons why you should reconsider those cards.1. There can be large welcome bonuses.2. They offer better rewards.3. There aren't foreign transaction fees.4. There are extra benefits.5. Travel credits offset…

Read More

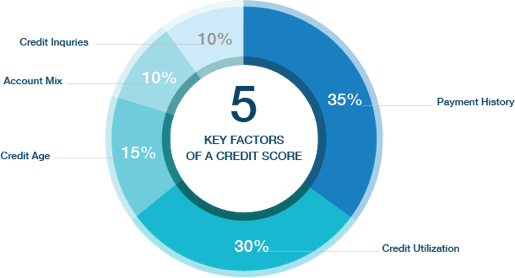

How Credit Scores Are Born

Ever wonder what goes into making your credit score? We’ll help break it down for you. Generally loans, interest rates, and all other finances get a lot pricier when your score falls below 750, despite the fact that a 700 score would be labeled as great. You can get better…

Read More

These 18 Things Can Harm Your Credit Score

Although your credit score is made up of just three little numbers, there are multiple factors that go into it. Many financial decisions can actually harm your score without you even knowing. Read on to ensure you are making these 18 common credit score missteps. Image via Flickr/Matt Madd Continue…

Read More

Learn How Your Credit Score Affects Your Mortgage Rate

The interest rate you get on your mortgage loan is one of the major factors in whether you can afford to buy a home. This rate is dependent on your financial health, most especially your credit score. Read on to learn how your score might affect your ability to purchase…

Read More